Legal framework, tax, sample option grant spreadsheet.

Disclaimer: This article is general information for founders, not legal or tax advice. Confirm specifics with counsel.

Employee ownership is possible in the UAE—you just need the right wrapper and clean paperwork. This founder‑friendly guide covers plan design, ADGM/DIFC vs mainland options, vesting and exercise mechanics, IFRS 2 accounting, and the UAE corporate tax context. It’s practical, not legal advice.

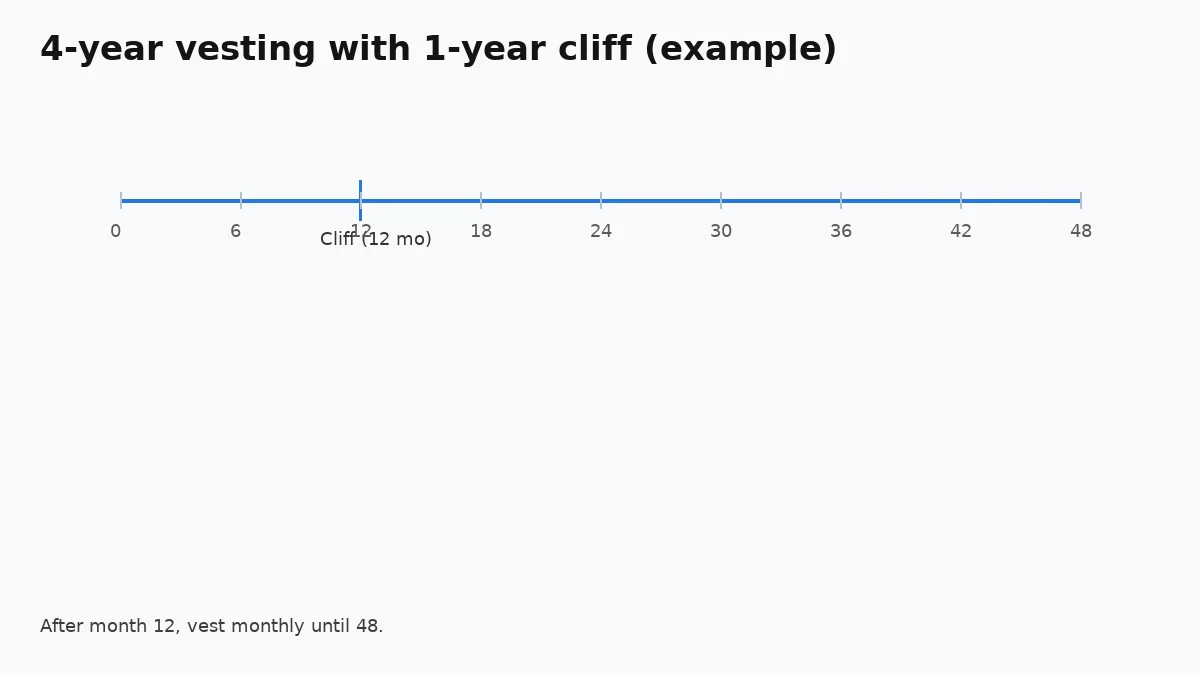

Key takeaways: Pick a legal wrapper early (often an ADGM/DIFC holding company or phantom plan). Keep the pool small but meaningful (10–15% typical). Standardise vesting (4‑year with 1‑year cliff) and track grants in one spreadsheet tied to the cap table.

Choose a wrapper early; keep the pool tight; document everything.

Create a simple plan with a 10–15% pool, 4‑year vesting with a 1‑year cliff, and board‑approved grants. Consider an ADGM/DIFC holding company or use a phantom plan where equity is impractical.

Document the ESOP (plan rules) plus a grant letter per person. Keep a single cap table that models dilution before/after the pool and future rounds. Account using IFRS 2 and disclose share‑based payment expenses.

Most venture‑backed UAE start‑ups use a holding company in ADGM or DIFC with an ESOP, or run a cash‑settled phantom plan if equity isn’t feasible in the operating entity.

ADGM/DIFC are common‑law jurisdictions with tooling for employee share schemes and flexible SPVs. Mainland companies may face constraints and use alternative structures or holding companies.

Options align with venture norms; RSUs suit later‑stage companies; phantom delivers cash on exit/liquidity when equity isn’t practical.

Pick based on governance load, accounting, and your pathway to liquidity. Spell out vesting, leaver rules, and treatment on exit.

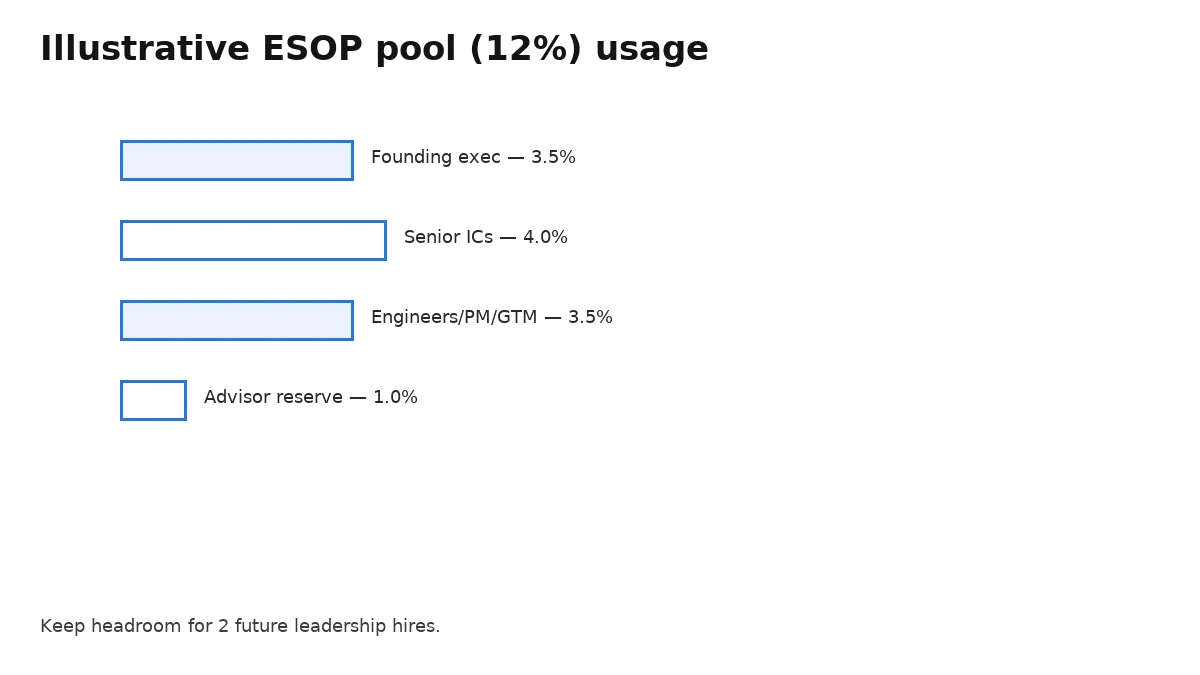

Start with 10–15% fully diluted; refresh at financing rounds. Model pre‑ and post‑money so everyone sees the impact.

Publish pool usage by band (founding, leadership, senior ICs) and avoid over‑granting early. Reserve for two future leadership hires.

A well-structured compensation plan also strengthens go-to-market execution. It helps attract and retain the commercial and partnership talent needed to convert market opportunities into predictable revenue.

Default to 4 years with a 1‑year cliff, then monthly thereafter. Define good/bad leaver, notice periods, and a 90‑day post‑termination exercise window (adjust to fit context).

Add double‑trigger acceleration for change‑of‑control if you need to compete for talent; keep it narrow to avoid undermining retention.

Equity‑settled options are expensed over the vesting period; cash‑settled (phantom) are re‑measured each reporting date. Disclose assumptions and method.

Work with your auditor on fair‑value methodology and inputs (volatility, expected life, risk‑free rate). Keep grant‑by‑grant records.

UAE corporate tax applies from June 2023 financial years; there’s no federal personal income tax today. Treat this as general context—get local tax advice for your facts.

Maintain payroll records that align with your plan and option exercises. Document how you handle buy‑backs and cash‑settled awards.

Board approves the plan and each grant; update articles where required; maintain an insider list and window policy around financings.

Keep signed plan rules, grant letters, and a current cap table. Re‑issue refreshed grant schedules after each round.

If ESOPs are part of your pitch, keep the careers page fast: INP ≤200 ms, LCP ≤2.5 s, CLS ≤0.1.

Optimise hero and proof images (≤150 KB WebP), reserve image dimensions, and defer non‑critical scripts.

Related reads: Seed Data‑room Checklist, Finance Stack (GCC), Outbound Sales Playbook.

Free‑zone holding companies (ADGM/DIFC) offer flexible share schemes; mainland entities may prefer phantom or grants via a holding company.

Common pattern: set up an ADGM or DIFC TopCo (or SPV) to issue options and hold the operating company. This keeps cap‑table mechanics standard for investors. Mainland operating entities often retain payroll and licences but do not issue options directly.

Ship these four files and keep signed copies.

Set a fair strike and document the method.

Unlike US 409A, there’s no single prescribed method, but auditors will expect a defensible fair‑value basis (market comps, last round price adjusted, or an independent appraisal). Record assumptions and keep them with the grant pack.

Model before you sign term sheets.

Start with founders 80%, seed investors 20%, and create a 12% ESOP pool pre‑Series A. After a 20% new round with 5% top‑up, founders might land ~52–56% depending on refresh size. Show employees pre‑ and post‑money views so they understand real ownership.

Define good/bad leaver and documentation clearly.

Keep one sheet; avoid copy‑paste drift.

Small habits prevent big headaches.

Run this before announcing to staff.

TopCo: holding company at the top of the group. SPV: special purpose vehicle (often for holding equity). Cliff: minimum service before first vest. Acceleration: vesting on events (e.g., acquisition). Fully diluted: assuming all options/convertibles become shares.

Review annually or at each financing.

Re‑confirm plan terms after new rounds; update valuation approach and grant ranges; re‑brief managers on how to explain value to candidates.

Quick answers on UAE ESOPs (not legal advice).

Want help designing a UAE‑ready ESOP that investors recognise?

© EA Partners 2025. All Rights Reserved.